Statistics Canada reported that the nation’s unemployment fell to 5.7% and that 107,000 jobs were gained after shedding jobs in March. This is the biggest one month increase with records going back to 1976. The record job growth beat market expectations of an addition of just 12,000 jobs or less. Canada added 426,400 jobs over the past 12 months, up 2.3%, which is the largest one-year increase since 2007 before the Great Recession. In the last two years, the economy has added 700,000 jobs.

The Numbers

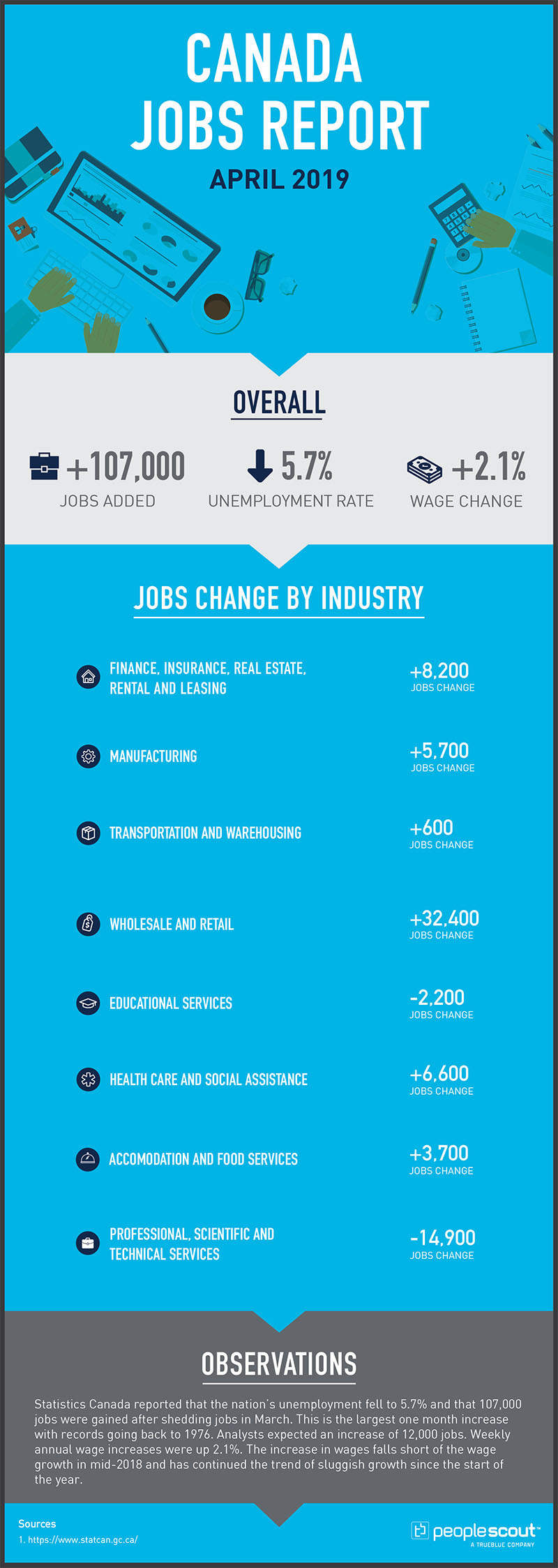

107,000: The economy added 107,000 jobs in April.

5.7%: The unemployment rate fell to 5.7%.

2.1%: Weekly wages increased 2.1% over the last year.

The Good

Employment increased in Ontario, Quebec, Alberta and Prince Edward Island. Several important sectors posted positive job numbers including wholesale and retail trade; construction; information, culture and recreation; public administration; and agriculture. The employment situation improved for some key demographic groups as well. There were job increases for youth aged 15 to 24, people aged 55 and older and women in the core working ages of 25 to 54.

In a hopeful sign for the economy, youth employment accounted for much of the gains in jobs in April, as unemployment for those aged 15 to 24 hit its lowest rate in 43 years. The Labour Force Survey reported that youth unemployment rate fell to 10.3% with jobs for Canada’s younger workers growing by 89,000 over the past year. The rate has not been that low since Statistics Canada starting using its current statistical criteria in 1976.

While the annual wage growth numbers are still not strong compared to other advanced economies, there are some signs of progress. While annual weekly wages decreased from last month, annual hourly wage gains increased to 2.5% in April, the fastest annual gain since September and up from 2.4% in March. Pay increases for permanent employees jumped to 2.6%, the largest increase since August.

The jobs report was welcomed by some analysts as a sign that employers are demonstrating confidence in the Canadian economy:

“’Nearly every indicator of quality came in strong this month: The best-ever gain came with solid full-time job growth, all in employees — rather than self-employed — more Canadians were drawn into labour markets and wages were up,’ said Brian DePratto, senior economist for TD Economics, in a written statement about the results.

‘Chalk this one up as a solid message that employers still have faith in the Canadian economy.’”

The Bad

While the report contained good news for much of Canada’s workforce, not every sector, province or demographic group fared well. Employment decreased in professional, scientific and technical services and in New Brunswick. The employment gains for the remaining provinces were negligible compared to Ontario, Quebec, Alberta and Prince Edward Island.

Contrasting with the vote of confidence that some have interpreted from the April report, some leading economists have recently expressed modest expectations for Canada’s economic growth this year:

“Deloitte’s latest economic advisory report projects a year of slower economic growth, a weak Canadian dollar, and a vulnerable economy. Though the dreaded “R-word” (recession) remains a possibility, the consultancy projects modest growth of 1.3% in 2019 and 1.5% in 2020 for Canada.

After posting strong growth of 3% in 2017, the Canadian economy slowed to 1.8% in 2018, and has little momentum heading into this year. Factors such as a drop in residential investment, weaker consumer spending, and a decelerating US economy are projected to moderate growth to 1.3% in 2019, according to Deloitte Canada.

Though the firm says a recession isn’t the most likely outcome, slowed economic growth does make Canada more vulnerable to risks like protectionism, Brexit, and low global interest rates.”

The Unknown

The validity of the data in the April report and the conclusions drawn by many economists was questioned on the day the report was released in Bloomberg:

“A loss of 7,200 jobs in March, and then a gain of 106,500 jobs in April. For David Rosenberg, Canada’s latest employment data just doesn’t add up.

Statistics Canada said Friday that Canadian employment increased by 106,500 positions in April, the biggest one-month increase in data going back to 1976. The country’s jobless rate fell to 5.7%, compared to 5.85 in March.

But Rosenberg, chief economist and strategist at Gluskin Sheff + Associates, says the country’s latest jobs numbers are hard to believe, given what’s happening in the Canadian economy.

‘Did you really believe that the Canadian labour market is so volatile that we could have a [7,200] decline in the labour force in one month, followed by a 100,000-increase in the next month? Is our labour market more volatile than the stock market is? It’s hard to believe,’ Rosenberg said in an interview with BNN Bloomberg Friday.

‘Somehow we’re creating record jobs and in the same survey in the United States, they’re losing jobs in a significant way. So what I’m trying to say is, calm down a little bit. There’s no way that the Canadian economy is nearly as strong as this number would lead you to suggest.’

Rosenberg took issue with a few details in StatsCan’s labour force survey, pointing to how most of the job gains were concentrated among youth, and in sectors such as construction and retail.

‘I thought we were battling a housing bubble in this country,’ Rosenberg said. ‘Meanwhile, we know that consumers are going on the debt treadmill and doing more to repair their balance sheets than head out to the shopping malls.’

Rosenberg, who has been known for his bearish views on Bay Street, questioned any cheering of the April labour figures.

‘It’s like you’re a teacher in high school and your dumbest student just handed in an ‘A’ report and you just don’t really know what to do with it,’ Rosenberg said. ‘I don’t give it an ‘A’ by the way.’”