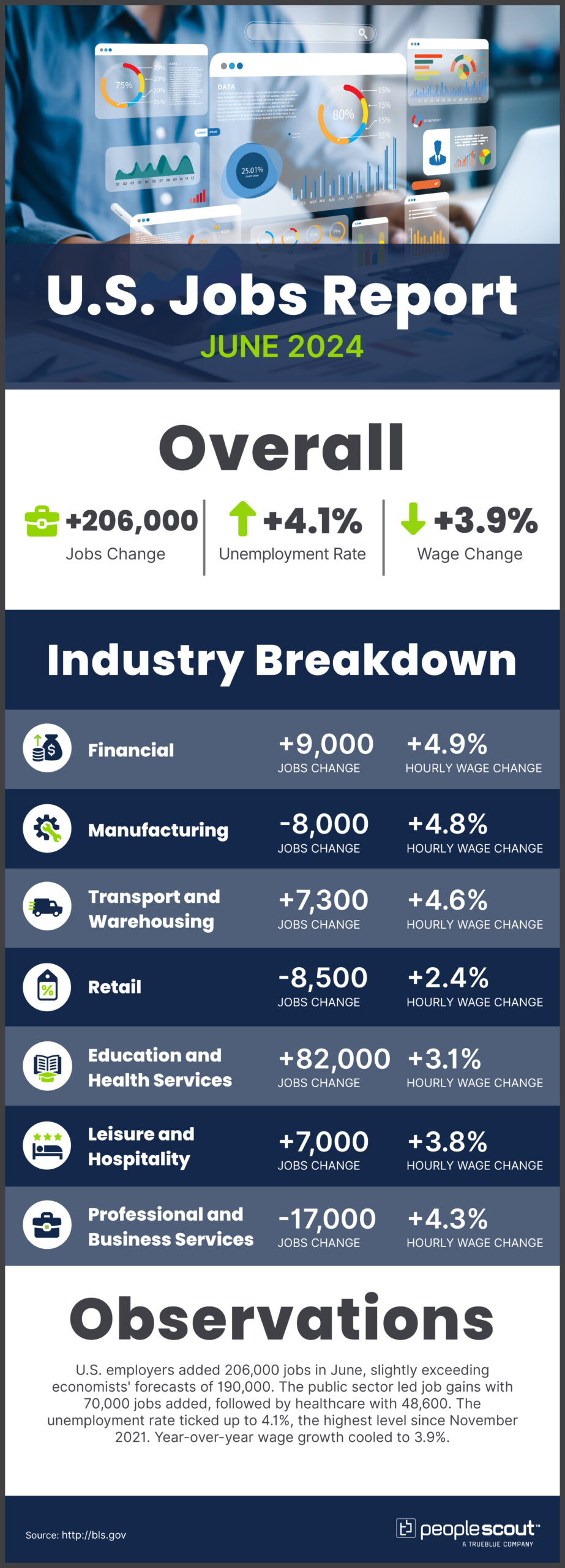

U.S. employers added 206,000 jobs in June, slightly exceeding economists’ forecasts of 190,000. The public sector led job gains with 70,000 jobs added, followed by healthcare with 48,600. The unemployment rate ticked up to 4.1%, the highest level since November 2021. Year-over-year wage growth cooled to 3.9%.

The Numbers

206,000: U.S. employers added 206,000 jobs in June.

4.1%: The unemployment rate rose to 4.1%.

3.9%: Wages rose 3.9% over the past year.

The Good

June’s job growth surpassed expectations, with payrolls expanding by 206,000 compared to the 190,000 forecasted by economists. This marks the 42nd consecutive month of job growth, the fifth-longest employment expansion on record. The public sector, particularly local government, showed significant growth and healthcare continued its strong hiring trend, adding 48,600 jobs. Overall, gains were more broad-based than previous months. This diversity can often signal a more stable job market overall. Wage growth, while cooling, still outpaces inflation at 3.9% year-over-year—a positive sign for consumer spending and economic health.

The Bad

Despite the solid job gains, there are indications that the labor market is losing some steam. The unemployment rate ticked up to 4.1%, crossing the 4% threshold for the first time since November 2021. This continues a gradual upward trend we’ve seen over the past year. Job openings have also been on a downward trajectory since their post-pandemic peak. While this could suggest a better balance between labor supply and demand, it also means job seekers might find the market a bit more competitive than in recent years.

The Unknown

The persistent question is how the Federal Reserve will interpret this jobs report in relation to its dual mandate of price stability and maximum employment. The cooling labor market, combined with easing inflation, has increased expectations for potential rate cuts— market watchers are predicting September as a possibility. However, the Fed has consistently emphasized that they’ll be looking at a broad range of economic indicators, not just jobs numbers, to guide their decisions. Therefore, future policy decisions will likely depend on upcoming economic data.

Conclusion

June’s jobs report presents a nuanced picture of the U.S. labor market. While job growth remains robust and broad-based, signs of cooling are evident in the rising unemployment rate and slowing wage growth. This moderation could be seen as positive, potentially bringing the job market into better balance without a harsh downturn. However, it also means both job seekers and employers may need to adjust their expectations in the coming months. As we move into the second half of 2024, all eyes will be on whether this “soft landing” can be sustained, or if more significant shifts in the labor market are on the horizon. The interplay between job growth, wage increases and the Fed’s policy decisions will be crucial in shaping the economic landscape ahead.