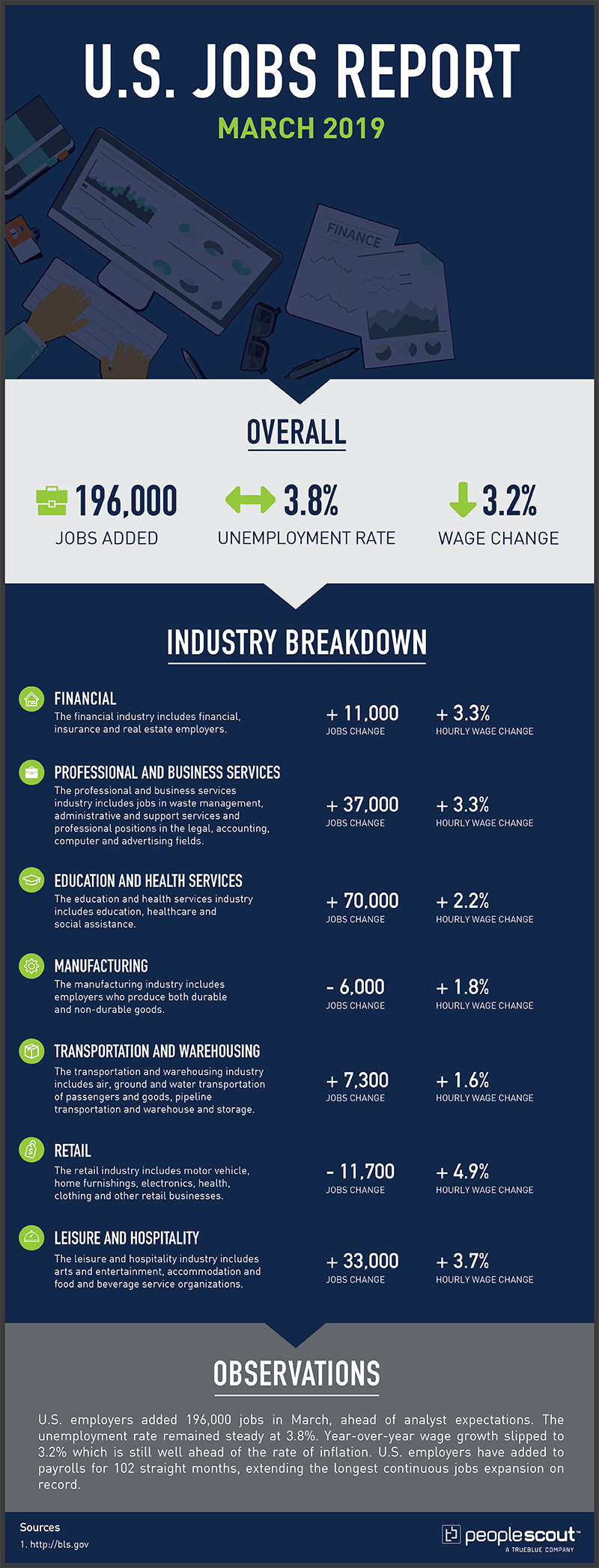

The Labor Department released its March jobs report which shows that U.S. employers added 196,000 jobs in March, higher than analyst expectations. The unemployment rate remained steady at 3.8% last month. Year-over-year wage growth decreased to 3.2%, which is more than twice the rate of inflation which was 1.5% in February. U.S. employers have added to payrolls for 102 straight months, extending the longest continuous jobs expansion on record.

The Numbers

196,000: The economy added 196,000 jobs in March.

3.8%: The unemployment remained at 3.8%.

3.2%: Wages increases fell to a rate of 3.2% growth over the last year.

The Good

Due to the weak February job report numbers, the March report was highly anticipated and the strong numbers came as a relief to those who feared an economic slowdown. Not only were the 196,000 jobs added well above expectations, the February job increases were revised from 20,000 up to 33,000. The New York Times noted:

“Everyone can relax a little.

The solid job gains that have come to define the current economic expansion resumed in March. The gain in hiring, though widely forecast, will help clear some of the doubts hanging over the economy. Though the economy is expected to slow this year from the strong pace of 2018, Friday’s report was a welcome sign.”

The healthcare sector was among the job creation leaders in March adding 49,000 jobs last month and 398,000 over the past 12 months. Employment in professional and technical services grew by 34,000 in March and 311,000 over the last year. Payrolls also increased last month in transportation and warehousing, leisure and hospitality, and the financial sector.

While the unemployment rate remained unchanged, the broadest measure of underemployment, which also includes part-time workers who would like full-time work, has dropped to a level not seen since the early 2000s.

In addition to strong job growth, the number of people seeking U.S. unemployment benefits fell to its lowest level since late 1969. This is a sign that employers are retaining their workers despite fears by some of a slowing economy.

The Bad

Annual wage growth fell to 3.2% after hitting a near decade high in February. The decline in wage growth is coupled with a decrease in those participating in the labor force and extremely high job vacancies. As Reuters reports:

“There are about 7.58 million open jobs in the economy. Vacancies could remain elevated as 224,000 people dropped out of the labor force last month. The labor force participation rate, or the proportion of working-age Americans who have a job or are looking for one, fell to 63.0% in March from 63.2% in February, which was the highest in more than five years.”

The large number of open jobs is not consistently attracting more Americans to join the workforce which puts considerable pressure on employers to compete for talent.

Despite overall job gains for the economy, manufacturing shed jobs for the first time since mid-2017. Until last month, manufacturers had enjoyed their longest job creation streak since the 1990s. The retail sector shed 11,700 jobs last month, continuing a trend of decreased employment in this sector.

The number of those working in temporary help services also declined last month. This drop in the temporary help sector may have broader implications for the labor market in coming months. The Washington Post noted:

“The level of temporary workers, while still high, has stalled this year, another sign the economy might be cooling as widely expected, noted said Erica Groshen, a visiting scholar at Cornell University and former head of the Bureau of Labor Statistics, the nonpartisan agency that tabulates the jobs data.

‘The labor market is very strong…the only slightly yellow warning sign is temporary help,’ she said. ‘It’s a leading indicator that can be a harbinger that companies are slowing down hiring or take a pause.’

Businesses typically hire temporary workers when they want to expand their workforce quickly, but those workers are also often the first to go when firms try to cut costs.”

The Unknown

While the United States is enjoying a record run of job growth, there are indicators that some Americans are not optimistic that this trend will continue. A recent Conference Board survey elicited responses that mirror those given before the last recession. The Daily Herald reports:

“The survey, a widely followed gauge of consumer confidence produced by the Conference Board, a business research group, goes beyond asking respondents about the state of the economy. It also asks whether they think jobs in their area are ‘plentiful’ or ‘hard to get.’

The collective responses to those questions can foreshadow how job growth and the unemployment rate will move over time. When more people say jobs are plentiful and fewer say they’re hard to get, hiring typically rises and the unemployment rate falls. Wages are also more likely to increase.

‘It’s a good predictor of how the labor market evolves,’ said Joe Song, senior U.S. economist at Bank of America Merrill Lynch.

In July 2007, the percentage of Americans who said jobs were plentiful exceeded those who said they were hard to get by 11 points, indicating a good job market. The unemployment rate was a low 4.7% that month.

But the gap between the proportion of respondents saying jobs were plentiful and those saying they were hard to get then fell steadily – until it was barely positive in December that year, when the recession officially began. The unemployment rate remained at 4.7% or lower for four months before jumping to 5% in December and kept rising as the recession worsened.

The Conference Board’s measure plunged into negative territory in 2008 and 2009 as far more Americans said jobs were hard to get than plentiful. It bottomed at minus 46.1 in November 2009, one month after unemployment peaked at 10%, the highest rate in 26 years.

Similar downturns in the Conference Board’s data preceded previous recessions.

‘It is highly correlated with unemployment,’ Gad Levanon, chief economist at the Conference Board, said. ‘They have very similar turning points.’

The measure now indicates a sturdy job market but one that may weaken a bit. In March, far more Americans said they thought jobs were plentiful than hard to get, but the gap between the two narrowed by the most since the recession. The decline could still be a blip rather than evidence of job-market weakening, Levanon cautioned.”