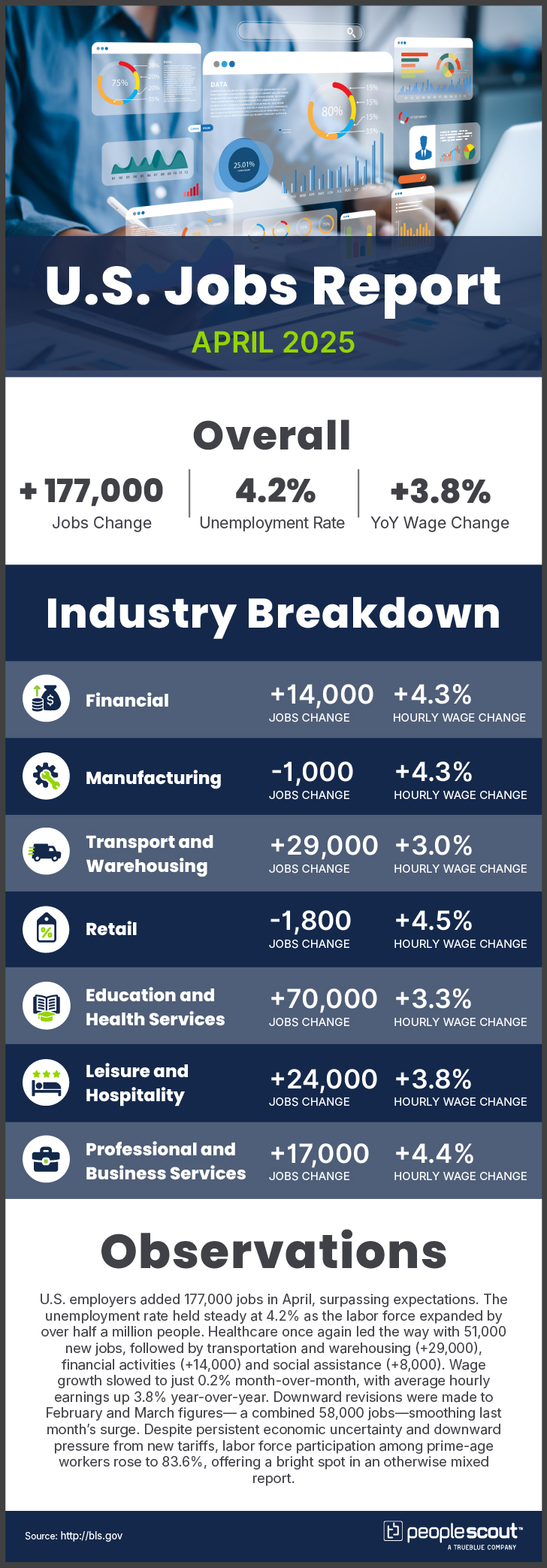

U.S. employers added 177,000 jobs in April, surpassing expectations. The unemployment rate held steady at 4.2% as the labor force expanded by over half a million people. Healthcare once again led the way with 51,000 new jobs, followed by transportation and warehousing (+29,000), financial activities (+14,000) and social assistance (+8,000). Wage growth slowed to just 0.2% month-over-month, with average hourly earnings up 3.8% year-over-year. Downward revisions were made to February and March figures— a combined 58,000 jobs—smoothing last month’s surge. Despite persistent economic uncertainty and downward pressure from new tariffs, labor force participation among prime-age workers rose to 83.6%, offering a bright spot in an otherwise mixed report.

The Numbers

- 177,000: U.S. employers added 177,000 jobs in March.

- 4.2%: The unemployment rate remained at 4.2%.

- 3.8%: Wages rose 3.8% over the past year.

The Good

U.S. employers added 177,000 jobs in April, outpacing expectations and extending the streak of monthly job gains to 52 consecutive months. Healthcare continued its role as a primary growth driver, adding 51,000 jobs, while transportation and warehousing surprised with 29,000 new positions—well above its 12-month average of 12,000. The labor force expanded by more than 500,000 people, and the prime-age labor force participation rate rose to 83.6%—its highest level since July 2023 and a sign of renewed worker confidence. The unemployment rate remained steady at 4.2%, holding at a historically healthy level.

The Bad

Wage growth continued to decelerate in April, with average hourly earnings rising just 0.2% month-over-month and 3.8% year-over-year, missing economist projections. Long-term unemployment also ticked up, with 23.5% of unemployed workers out of work for 27 weeks or more—matching pandemic-era highs. Downward revisions to February and March payrolls cut a combined 58,000 jobs from earlier estimates, tempering the perceived strength of recent months. Federal government employment declined by 9,000 amid continued agency reductions, and sectors such as manufacturing, retail, construction and professional services saw little or no job growth, suggesting uneven recovery across the economy.

The Unknown

While April’s headline job number was solid, questions remain about how sustainable this pace is in the face of growing macroeconomic headwinds. The unusual surge in transportation and warehousing jobs (+29,000) has been attributed to pre-tariff purchasing activity, but the sustainability of this trend remains unclear. The muted wage growth could reflect employer caution or shifts in hiring toward lower-wage roles. The balancing act between inflationary concerns and recession risks leaves the Fed in a challenging position as it navigates competing economic priorities. It remains unclear how labor market dynamics will evolve heading into the summer.

Conclusion

The April 2025 jobs report presents a labor market that remains resilient despite mounting headwinds. Strong headline job growth and a rise in prime-age labor force participation are encouraging, but cooling wage gains, long-term unemployment and downward revisions to previous months’ gains point to a more cautious hiring environment. As broader economic uncertainties persist, the coming months will be crucial in determining whether April’s performance represents sustainable momentum or merely a temporary bright spot before more challenging conditions emerge.

![[Webinar] Smart Hiring in the AI Age: What UK Candidates Are Really Doing in 2025](https://www.peoplescout.com/wp-content/uploads/2025/05/AI-enable-applicant-report-320x320.jpg)