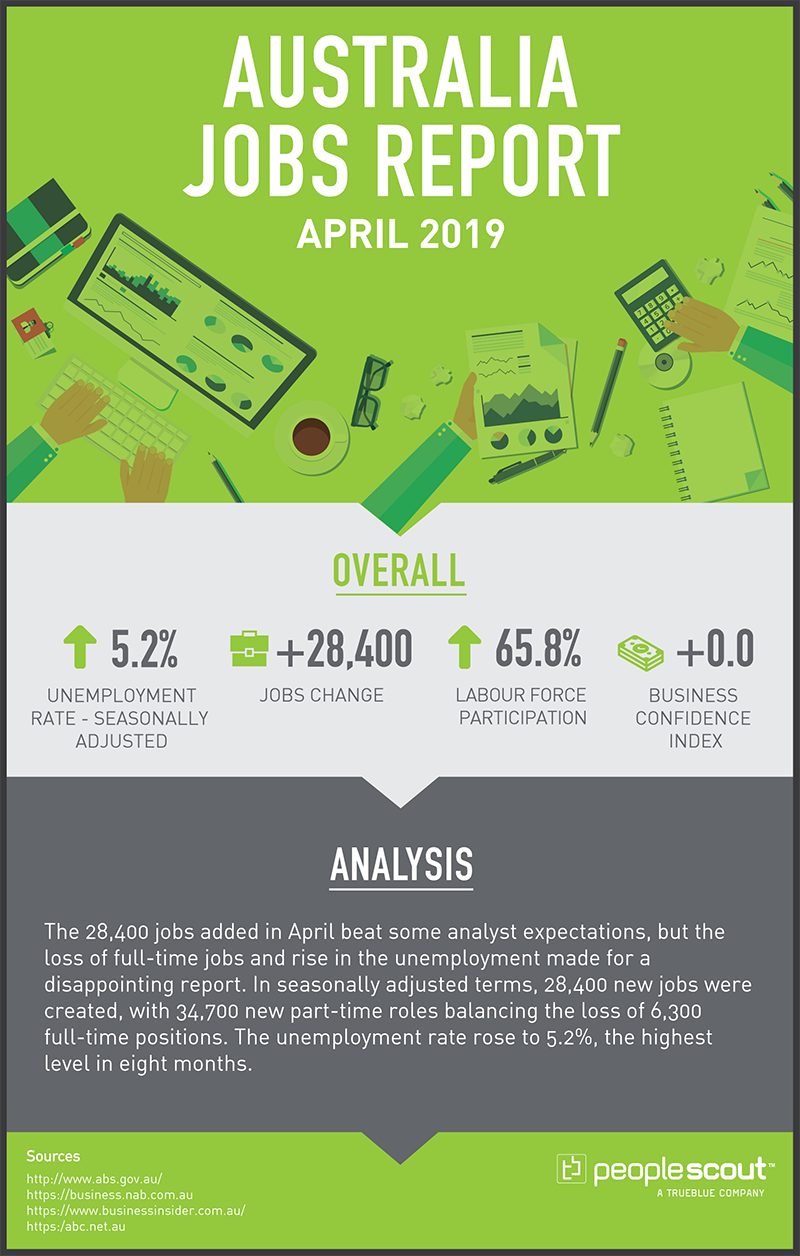

The 28,400 jobs added in April beat some analyst expectations, but the loss of full-time jobs and rise in the unemployment rate made for a disappointing report.

The Numbers

28,400: The Australian economy added 28,400 jobs in April.

5.2%: The Australian unemployment rate rose to 5.2%.

65.8%: Labour force participation rose to 65.8%.

0: The Business Confident Index fell to 0 from our last update in the latest NAB release.

Upside

The Australian economy added 28,400 jobs in April, beating analyst expectations. The labour force participation rate rose to 65.8%, a record high showing broad confidence in the nation’s job market. Since April 2018, full-time employment increased by 248,100 and part-time employment increased by 74,800.

States with job growth include New South Wales (up 25,100), followed by Western Australia (up 6,400) and Queensland (up 5,400).

Downside

The job growth was entirely due to part-time positions. The 34,700 new part-time roles balanced the loss of 6,300 full-time jobs. The unemployment rate rose to 5.2%, the highest level in eight months. Victoria had a net job loss of 7,600. The nation’s youth unemployment – people aged between 15 and 24, rose 0.1 points higher to 11.8%.

Another troubling indicator is the increase in the underutilisation rate which went from 13.3% to 13.7% in one month. Underutilisation includes unemployed Australians and those working who want to work more.

The data released in the report, coupled with the news that online job ads have fallen to six-year lows have led some analysts, including RBC’s Richard Thompson, to assert that the unemployment rate is not likely to fall any time soon:

“Given the suite of lead employment/vacancy indicators mostly suggesting further softening in labour market conditions ahead, it is difficult to imagine that unemployment will get back below the 5% mark.”

Fall in Online Job Ads – A Negative Indicator?

Business Insider Australia reports that job advertisements placed on employment platform SEEK fell 8.9% annually in April. Postings fell in all job categories and in all states except the Australian Capital Territory. Ads in media, trades, construction, real estate and architecture fell more than 20% over the year. Job ads in 15 categories fell more than 10%. The article notes, “if the data is reflective of a broader demand for workers, it isn’t looking good for anyone seeking employment in the second half of the year.”

A decrease in online job postings does not necessarily indicate a softening job market. In May 2018, online job ads decreased by 51,000 in the U.S. when the unemployment rate stood at 3.8%. Nearly one year later, in April 2019, it was 3.6%. A decrease in the number of online job postings may reflect, at least in part, that enterprises are successfully utilizing creative strategies to attract talent beyond traditional job boards.