Statistics Canada reported that the nation’s unemployment rate rose to 5.8% due to more people entering the job market while wage growth continued to be sluggish. Canada added 66,800 jobs in January which greatly exceeded analyst expectations. Part-time job increases outpaced full-time job growth. The number of private-sector positions grew by 111,500 in January for the category’s biggest month-to-month increase since the agency started reporting this statistic in 1976.

The Numbers

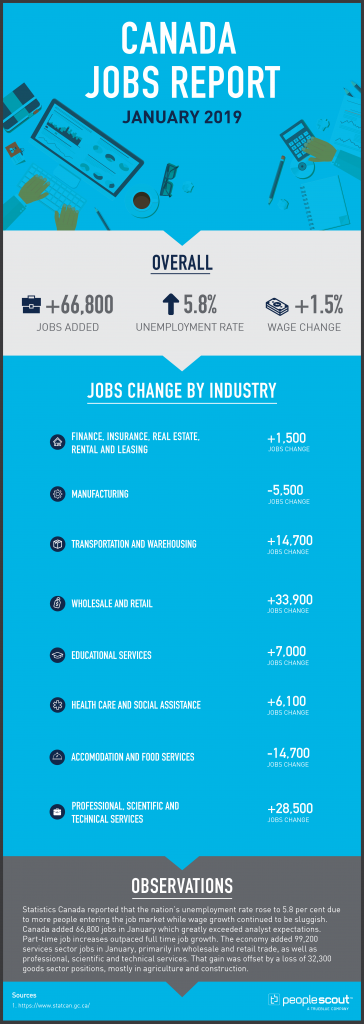

66,800: The economy gained 66,800 jobs in January.

5.8%: The unemployment rate rose to 5.8%.

1.5%: Weekly wages increased 1.5% over the last year. This is a 0.3% decrease from December’s wage growth figure.

The Good

The 66,800 jobs that were added to the Canadian economy were a welcome surprise since some economists were predicting a gain of only 5,000 jobs. This unexpected increase in jobs occurred during a time of volatility in the financial markets, low consumer confidence, falling oil prices and uncertainty over trade.

On a year-over-year basis, total employment was up 327,000 or 1.8%, with increases in both full-time and part-time work. The increased unemployment rate was due to more Canadians entering the job market.

In addition to good news for the private sector, there were healthy employment increases for Canada’s young people. The number of employed youth aged 15 to 24 was up 53,000 in January, split evenly between men (+27,000) and women (+26,000).

There were notable job increases in Ontario and Quebec, Canada’s largest provinces. The number of people employed rose by 41,000 in Ontario and 16,000 in Quebec where the uptick was driven by younger workers.

The Bad

The job gains in Ontario and Quebec contrasted with the employment situation in Alberta which posted declines for the second consecutive month. Employment was down by 16,000 in January with the unemployment rate increasing by 0.4 percentage points up to 6.8 per cent. In addition to the localized job losses, slow wage growth continues to be a concern.

While year-over-year average hourly wage growth in January for permanent employees was 1.8 per cent, which was up from December’s reading of 1.5 per cent, it was still well below the May 2018 peak of 3.9 per cent. The rate of average weekly wage growth actually decreased to the same rate of 1.5 per cent. This sluggish growth defies the conventional expectations of wages rising when unemployment is low, and Canadian economists are searching for answers.Coverage of The Bank of Canada’s Senior Deputy Governor Carolyn Wilkins’ thoughts on modest wage growth in the context of a strong job market noted:

“An economy with a tight labor market should be able to produce wage growth of around 3 per cent, according to Wilkins. She found an important factor for the sluggishness was lagging pay in oil-producing regions. There are also some other sectoral changes going on in the economy such as fast growth in service- sector jobs. But those don’t fully explain the phenomenon.

‘Even after accounting for these regional and sectoral factors, wage growth overall is still a bit short of what one would expect at this stage,’ she said. She outlined a list of other potential factors that included: skills mismatches, caution among workers to change jobs, reluctance to move, expensive housing in some markets, and global structural factors such as technological disruption and growing market concentration.”

The Unknown

How long will job growth continue in Canada? Some economists and business leaders fear that a recession may be imminent while others express optimism about the nation’s economic health.

“In baseball parlance, I’d say that we’re top of the ninth, with one out,” Gluskin Sheff + Associates’ chief economist and strategist told BNN Bloomberg’s Greg Bonnell in an interview on Friday.

Rosenberg also said the Canadian economy is more than 90 per cent of the way through the business cycle.

“The market action and all the volatility, the yield curve, the behaviour of cyclical stocks especially in the past six months, commodities – and, notwithstanding the knee-jerk bounce that we had in the opening weeks of this year – I think that the odds of a recession in 2019 are elevated,” Rosenberg said.

A contrasting viewpoint can be found in recently published reports by the nation’s leading financial institutions:

“While growth in Canada’s broader economy moderates, Canadian business owners are generally positive about their prospects, finds an economic outlook report from Bank of Montreal. The report identifies two themes playing out across the country.

“First, oil prices have again become a downside risk for the three producing provinces,” says Robert Kavcic, BMO senior economist, in the report. Second, “most provinces are coming off very strong runs and are in the process of moving back in line with their longer-run growth rates,” he says.

The report finds that businesses are investing in innovation to increase productivity, and expanding into new markets, such as the U.S., to increase growth potential. For example, while Alberta’s growth is forecast at only 1.5 per cent this year, innovation in technologies geared toward oil exploration and pipeline management remains a bright spot for its economy, as start-ups continue to emerge.

In a January economics report, RBC senior economist Josh Nye also said business confidence was holding up, despite a relatively soft handoff for GDP at the turn of the year because of energy-sector challenges. He cited Canada’s addition of 115,000 jobs in the last quarter of 2018 and an unemployment rate that fell to a 44-year low.

“Further, the Bank of Canada business outlook survey showed generally positive sentiment, he said.”