Statistics Canada released its July 2018 Labour Force Survey which shows 54,100 jobs added to the Canadian economy. That number impressively exceeded analyst expectations of 17,000. Unemployment fell by 0.2 percentage points to 5.8 per cent, a four-decade low. Wage growth slowed from previous months, and the bulk of the job growth came from part-time jobs.

The Numbers

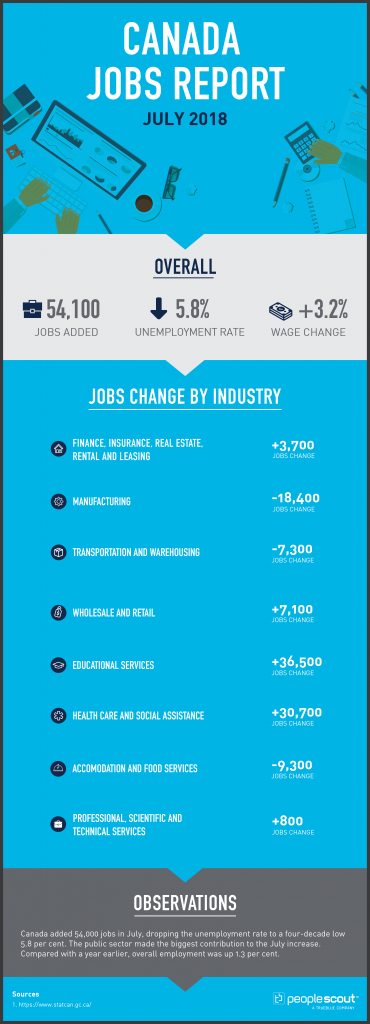

54,100: The economy added 54,100 jobs in July.

5.8%: The unemployment rate fell to 5.8 per cent.

3.2%: Wages increased 3.2 percent over the last year.

The Good

Strong employment gains were made in major service-producing sectors including educational services; health care and social assistance; and information, culture and recreation. Over a one year period, employment grew by 246,000 (+1.3 per cent). These gains were largely the result of growth in full-time work (+211,000 or +1.4 per cent).

For the core-aged (25 to 54) population, employment increased by 35,000, boosted by gains among women (+30,000). The unemployment rate for women in this age group was down 0.3 percentage points to 4.9 per cent. Over a one year period, employment grew for both women (+72,000 or +1.2 per cent) and men (+41,000 or +0.6 per cent) in the core-aged group.

The Bad

According to the July report, Canada added 82,000 less desirable, part-time positions last month and lost 28,000 full-time jobs. The overall positive impact on the economy is diminished by the smaller income available to Canadian families than if the gains had been made in full-time positions.

The public sector made the biggest contribution to the July increase with 49,600 new jobs, while the private sector added only 5,200 positions. National Bank of Canada chief economist Stefane Marion wrote in a report Friday that the public sector is the “only game in town” so far in 2018. Marion’s research note was titled, “Where are the private sector jobs?”

The Unknown

Canadian analysts noted the mixed messages from July’s report. CTV News cited a research note from the Canadian Imperial Bank of Commerce, “In the wacky world of Canada’s monthly employment numbers, July came up with another head-scratcher, with some big headlines but some disappointments in the fine print,” CIBC chief economist Avery Shenfeld wrote Friday in a research note to clients.

Shenfeld added that there are “lots of reasons to question just how good the data really are here.”

Overall, he said the report contained a “good” set of numbers that will keep markets guessing whether the Bank of Canada will introduce its next interest rate hike in September or October. CIBC predicts the next rate increase will land in October as the central bank continues to proceed cautiously along its rate-hiking path.

![[Webinar] Smart Hiring in the AI Age: What UK Candidates Are Really Doing in 2025](https://www.peoplescout.com/wp-content/uploads/2025/05/AI-enable-applicant-report-320x320.jpg)