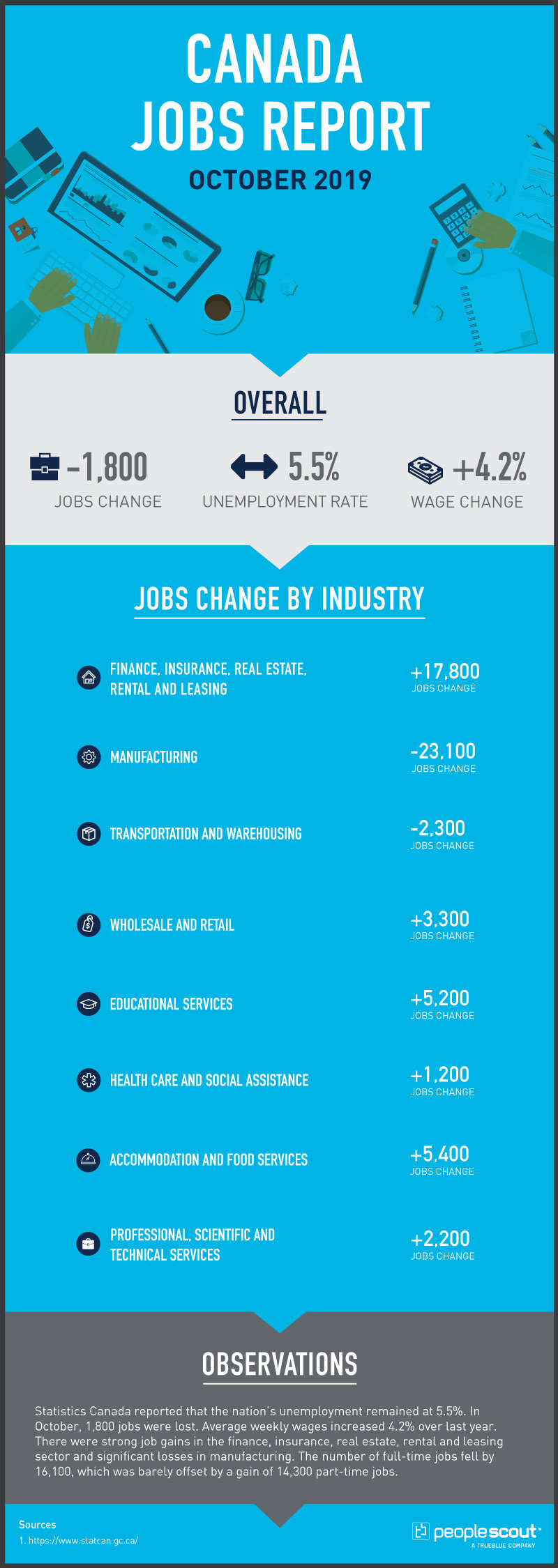

Canada’s unemployment remained at 5.5%. In October, 1,800 jobs were lost. Average weekly wages increased 4.2% over last year. There were strong job gains in the finance, insurance, real estate, rental and leasing sector and significant losses in manufacturing. The number of full-time jobs fell by 16,100, which was barely offset by a gain of 14,300 part-time jobs.

The Numbers

-1,800: The economy lost 1,800 jobs in October.

5.5%: The unemployment rate fell remained at 5.5%.

4.2%: Weekly wages increased 4.2% over the last year.

The Good

Statistics Canada reported that strong wage growth continued in October with average weekly wages growing by 4.2% over the last year. Average annual hourly wages grew by an even stronger 4.3%, the same as in September. On a year-over-year basis, employment in Canada increased by 443,000 or 2.4%, driven by gains in full-time work. During the same period, total hours worked were up 1.3%.

There were 17,800 job gains in the finance, insurance, real estate, rental and leasing sector, suggesting a healthy demand for talent in these important areas of the Canadian economy. The public sector also had a notable increase of 28,700 employees. Older Canadians also experienced an increase in their workforce numbers in October. Employment for people aged 55 and over rose by 31,000, with increases for both men (+17,000) and women (+15,000). The unemployment rate for this age group declined 0.2 percentage points to 4.7%. On an annual basis, employment for this group grew by 187,000 (+4.6%).

Employment increased in British Columbia (+15,300) and Newfoundland and Labrador (+2,700).

The Bad

After gaining of 54,000 jobs in September and 81,000 in August, the Canadian economy lost 1,800 jobs in October. Economists had predicted an increase of nearly 16,000 jobs. Major contributors to the job losses were construction and manufacturing, which fell by 21,300 and 23,100, respectively. Trade uncertainties have a negative impact on manufacturing and continued unease over trade has led some economists to temper their forecasts about Canada’s near-term economic growth.

While the Bank of Canada revised its 2019 Canadian growth projection up to 1.5% from 1.3%, it reduced its 2020 and 2021 forecasts to 1.7% from 1.9% and 1.8% from 2.0%, respectively. This was in part due to weaker foreign demand and trade uncertainty. BMO’s Chief Economist Doug Porter when interviewed stated “it’s pretty clear” the central bank is worried about global trade, adding it “gave a number of hints they would be prepared to move if things deteriorate at all in the months ahead.”

Although New Foundland and Labrador had slight job gains in October, the Maritime Provinces continue to experience unemployment rates that could more commonly be found during periods of recession. Newfoundland and Labrador unemployment stands at a staggering 11.1%, Prince Edward Island at 8.4%, Nova Scotia at 8.0% and New Brunswick at 8.3%.

The Unknown

Statistics Canada reported in October that over 1 million Canadians are holding down more than one job and are working more than 50 hours every week. Canadians working multiple jobs has nearly doubled since 1978, growing quickly in the 1980s, and then rising to 5.7% of all Canadian workers in 2018.

The report found that women, part-time workers and Canadians in their 20s are the most likely to have multiple jobs. It also reported that Canadians who hold more than one job typically work in sectors with strong female participation such as health care and social assistance, and educational services.

A recent Bank of Canada survey found that one-third of Canadians chose to engage in “informal work,” which includes driving for a ride-sharing service, housecleaning and babysitting, due to their need for additional income.

While it is clear that a significant number of Canadians are working long hours and at more than one job, what is less clear is the number of these workers who have searched for new positions with more competitive wages. Finding new employment which provides better income could eliminate the need for informal work and holding more than one job.

The lack of free-time that many of these workers experience may inhibit their ability to conduct a successful job search. The challenge for Canadian employers looking for talent is to attract those who are working multiple jobs that have the skills, or the ability to be trained, and whose income needs can be met by their enterprise’s open positions.

While multiple-job holders may be motivated to pursue new opportunities once they become aware of them, finding the right candidates among them may be a challenge. To reach this group of potentially untapped talent, employers should leverage the experience and expertise of a recruitment process outsourcing company. The result could be the onboarding of hard-working, and grateful, new employees.