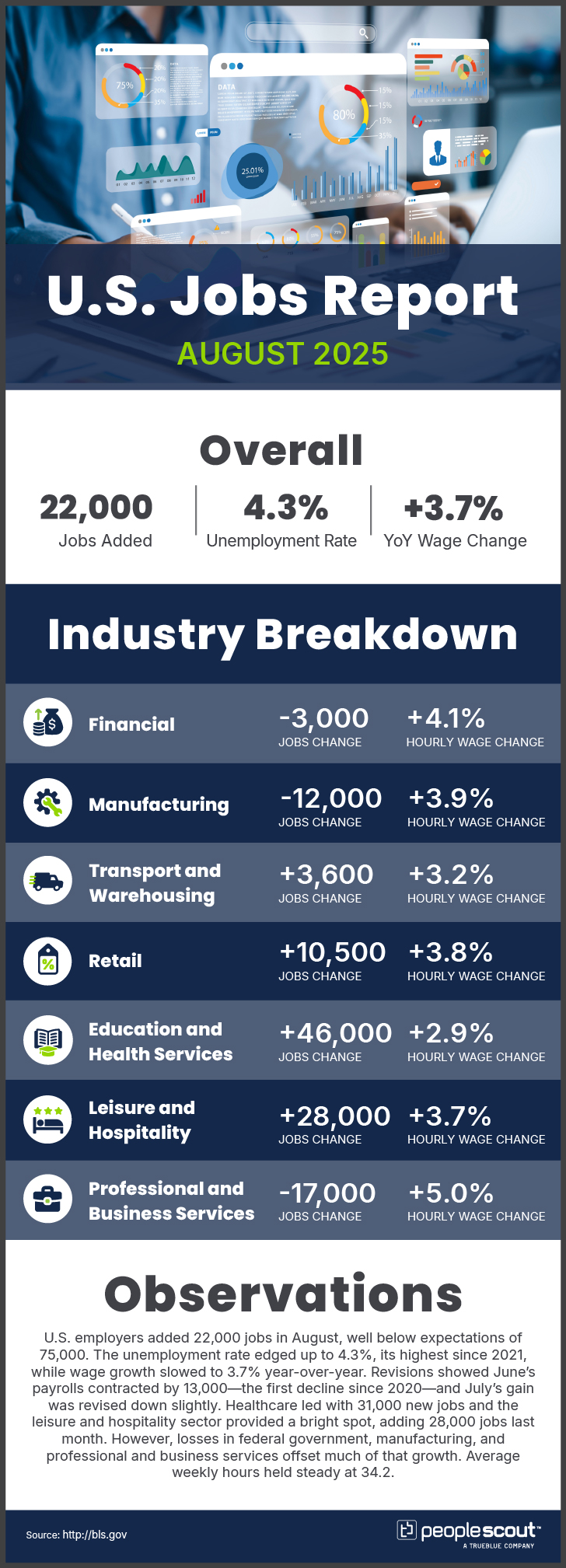

U.S. employers added 22,000 jobs in August, well below expectations of 75,000. The unemployment rate edged up to 4.3%, its highest since 2021, while wage growth slowed to 3.7% year-over-year. Revisions showed June’s payrolls contracted by 13,000—the first decline since 2020—and July’s gain was revised down slightly. Healthcare led with 31,000 new jobs and the leisure and hospitality sector provided a bright spot, adding 28,000 jobs last month. However, losses in federal government, manufacturing, and professional and business services offset much of that growth. Average weekly hours held steady at 34.2.

The Numbers

- 22,000: U.S. employers added 22,000 jobs in August.

- 4.3%: The unemployment rose slightly to 4.3%.

- 3.7%: Wages rose 3.7% over the past year.

The Good

Healthcare and social assistance once again provided stability, with healthcare adding 31,000 jobs and social assistance contributing 16,000. Leisure and hospitality also posted modest gains (+28,000), signaling ongoing demand for services in that sector. The prime-age labor force participation rate rose to 83.7%, indicating that more people in their peak working years are entering or re-entering the job market. Average weekly hours remained steady at 34.2, suggesting that employers are maintaining labor utilization rather than scaling back on hours worked.

The Bad

Overall job growth was minimal at just 22,000, well below forecasts of 75,000. Revisions showed that June’s payrolls contracted by 13,000—the first monthly decline since December 2020—while July’s figure was trimmed by 8,000. Job losses were broad-based, with federal government employment falling by 15,000, professional and business services shedding 17,000 and manufacturing down 12,000. Wage growth slowed to 3.7% year-over-year, its weakest pace in more than a year, and broader unemployment, which includes those working part time for economic reasons, rose to 8.1%.

The Unknown

The concentration of gains in healthcare and social assistance raises questions about whether broader private-sector demand is weakening. Rising unemployment may reflect more workers re-entering the labor force, but elevated continuing claims suggest it is taking longer to find new jobs. Policy uncertainty and shifting trade conditions continue to weigh on employer confidence, while the Federal Reserve faces a balancing act between slowing job growth and ongoing inflation concerns. The pace and timing of interest rate cuts will play a key role in shaping the labor market outlook for the remainder of the year.

Conclusion

The August jobs report underscores a labor market that is stalling, with limited job creation and downward revisions to prior months tempering recent momentum. Still, steady hiring in care-related sectors, stable weekly hours and higher prime-age participation highlight areas of resilience. As the labor market adjusts to shifting economic and policy dynamics, organizations will need to focus on flexible talent strategies and workforce planning to navigate an environment of slower growth and greater uncertainty.