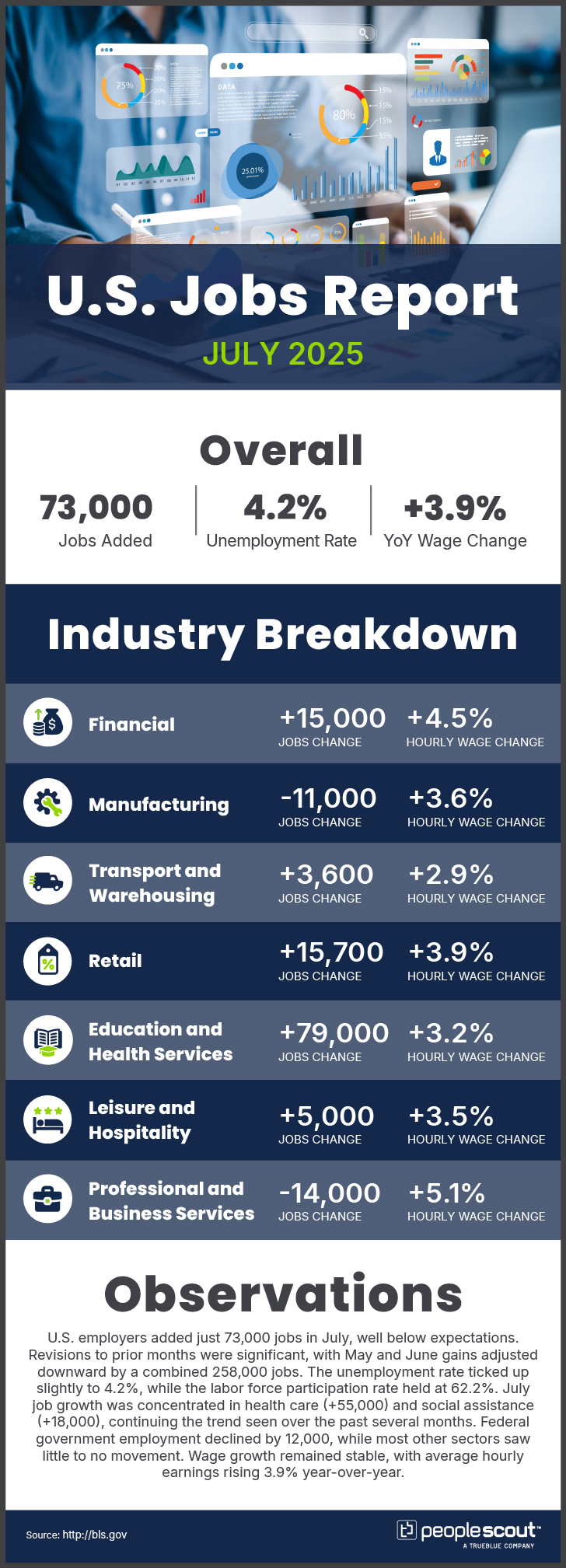

U.S. employers added just 73,000 jobs in July, well below expectations. Revisions to prior months were significant, with May and June gains adjusted downward by a combined 258,000 jobs. The unemployment rate ticked up slightly to 4.2%, while the labor force participation rate held at 62.2%. July job growth was concentrated in health care (+55,000) and social assistance (+18,000), continuing the trend seen over the past several months. Federal government employment declined by 12,000, while most other sectors saw little to no movement. Wage growth remained stable, with average hourly earnings rising 3.9% year-over-year.

The Numbers

- 73,000: U.S. employers added 73,000 jobs in July.

- 4.2%: The unemployment rose slightly to 4.2%.

- 3.9%: Wages rose 3.9% over the past year.

The Good

While July’s headline number fell short of expectations, several indicators suggest ongoing resilience in key areas of the labor market. Healthcare once again served as a bright spot, adding 55,000 jobs—well above its 12-month average—while social assistance roles increased by 18,000. These two sectors accounted for nearly all net job growth, underscoring persistent demand in care-related industries. Wages also continued to rise, with average hourly earnings up 3.9% year-over-year, outpacing inflation and contributing to real income gains. Additionally, the average workweek edged back up to 34.3 hours, providing a reassuring signal that employers are maintaining labor utilization.

The Bad

Total nonfarm payroll growth slowed to just 73,000 jobs in July, its weakest pace since March. More notably, revisions to May and June figures erased a combined 258,000 previously reported gains, suggesting the labor market has been cooling more than initially understood. The unemployment rate rose slightly to 4.2%, while the labor force participation rate held at 62.2%—both relatively flat but trending below recent highs. Job losses continued in the federal government (-12,000) and most other major industries showed little or no growth, pointing to a broad-based slowdown in hiring.

The Unknown

July’s report adds to growing uncertainty about the direction of the labor market in the second half of the year. While some sectors remain stable, the sharp revisions and widespread hiring stagnation raise questions about employer confidence amid ongoing economic pressures. Factors such as shifting trade dynamics, geopolitical risk and tighter financial conditions may be influencing hiring decisions. At the same time, the Federal Reserve’s wait-and-see stance may persist given the mixed signals—slowing job growth alongside stable wages and hours worked. Whether July marks a temporary pause or a more sustained cooling trend remains to be seen.

Conclusion

The July 2025 jobs report reveals a labor market that is clearly losing steam, though not yet in retreat. Job growth slowed and previous months’ strength was revised downward, but steady wage gains, stable workweek hours and continued hiring in care-related sectors offer some encouraging signs. As broader hiring momentum fades, organizations will need to focus on workforce agility and precision in talent strategy to maintain productivity and prepare for an increasingly uncertain economic landscape.