Following the federal government shutdown, the Bureau of Labor Statistics has released a combined October/November 2025 employment report, offering an unusually fragmented snapshot of the labor market. Abbreviated October payroll data showed a loss of 105,000 jobs, driven largely by federal government employment declines tied to earlier buyouts and administrative changes. November data—collected after the shutdown ended—showed a rebound of 64,000 jobs, modestly exceeding expectations but still consistent with a labor market that has seen little net growth since spring. The unemployment rate rose to 4.6%, its highest level in four years, underscoring ongoing cooling beneath the headline recovery. Healthcare and construction again led job creation, while Transportation & Warehousing, Manufacturing and Leisure & Hospitality continued to contract.

The analysis below reflects the November 2025 data shared in the latest BLS report.

The Numbers

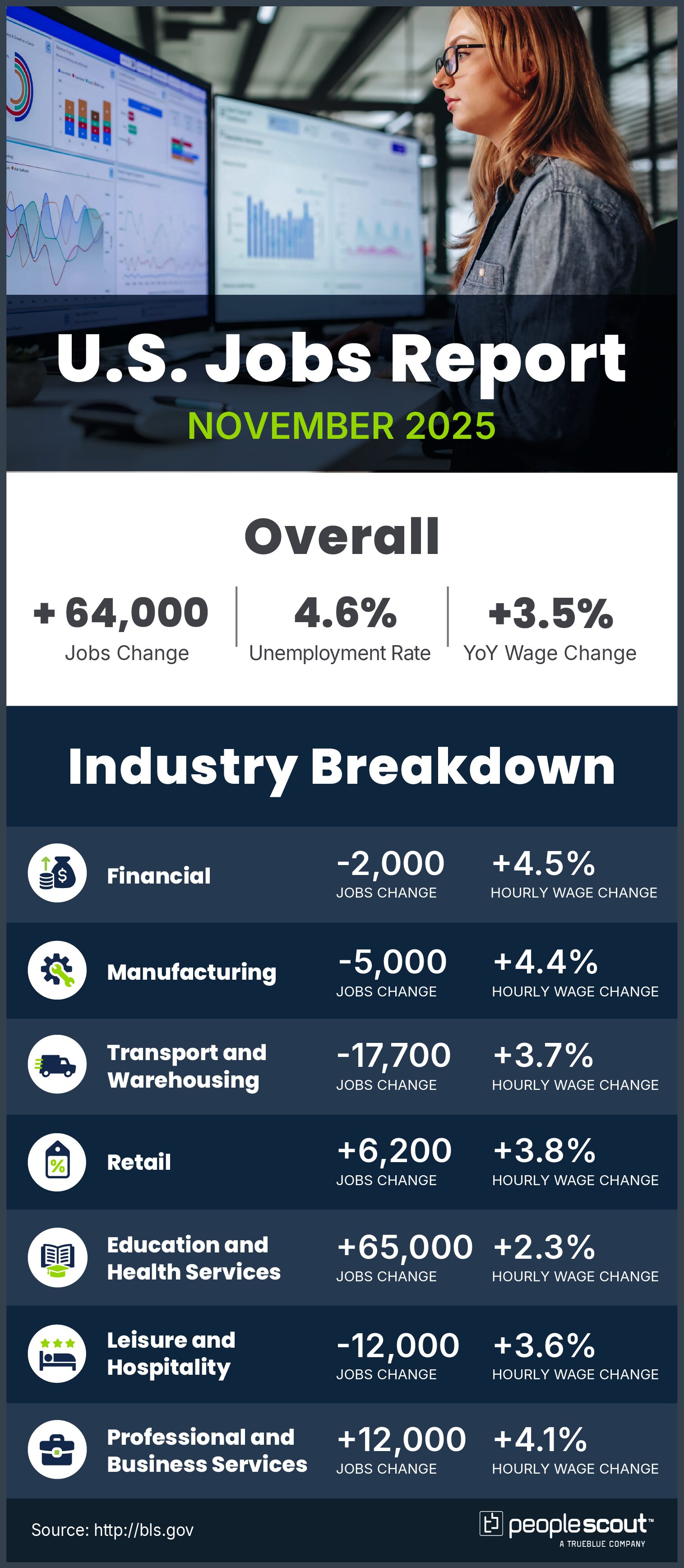

64,000: U.S. employers added 64,000 jobs in November.

4.6%: The unemployment rose slightly to 4.6%.

3.5%: Wages rose 3.5% over the past year.

The Good

November’s rebound in payroll growth suggests the labor market retains some underlying resilience despite significant disruption. Nonfarm payrolls rose by 64,000—above expectations—led overwhelmingly by Healthcare, which added 46,000 jobs and accounted for more than 70% of total gains. Construction also posted a solid increase (+28,000), reflecting continued demand for nonresidential projects, while Social Assistance added 18,000 jobs. Wage growth, though slowing, remains positive, with average hourly earnings up 3.5% year-over-year—still outpacing inflation. Labor force participation held steady at 62.5%, and average weekly hours were largely unchanged.

The Bad

Taken together, October and November reinforce the picture of a labor market recalibrating after several years of unusually strong growth. October’s 105,000 job loss—one of only a handful of negative payroll months in the past two years—highlights the extent to which government employment declines are weighing on overall figures. Even with November’s rebound, total payroll growth has shown little net change since April. The unemployment rate climbed to 4.6%, up from 4.4% in September, while broader measures of underemployment rose to 8.7%, reflecting an increase in workers holding part-time roles for economic reasons. Industry weakness remains, with Transportation & Warehousing, Manufacturing and Leisure & Hospitality continuing to shed jobs. Revisions to prior months were also negative, further dampening the apparent strength of recent hiring.

The Unknown

The extended government shutdown has temporarily limited the clarity of near-term labor market signals. At the same time, policymakers are navigating a delicate balance: job growth is slowing, unemployment is rising and wage pressures are easing, yet inflation remains a concern. The Federal Reserve has already cut interest rates multiple times but has signaled a higher bar for additional easing, particularly given data disruptions. Upcoming benchmark revisions and methodological changes scheduled for early 2026 may further reshape the employment picture.

Conclusion

The latest jobs report paints a labor market that is uneven and in transition, shaped by both structural adjustments and short-term disruption. While November’s modest rebound offers some reassurance, it does little to offset October’s sharp losses or the broader trend of stalled job growth. With unemployment edging higher and hiring concentrated in a narrower set of sectors, employers are operating in an uncertain environment. As more complete data becomes available in early 2026, organizations should remain cautious—focusing on workforce flexibility and targeted talent investments to stay prepared for further shifts in economic conditions.