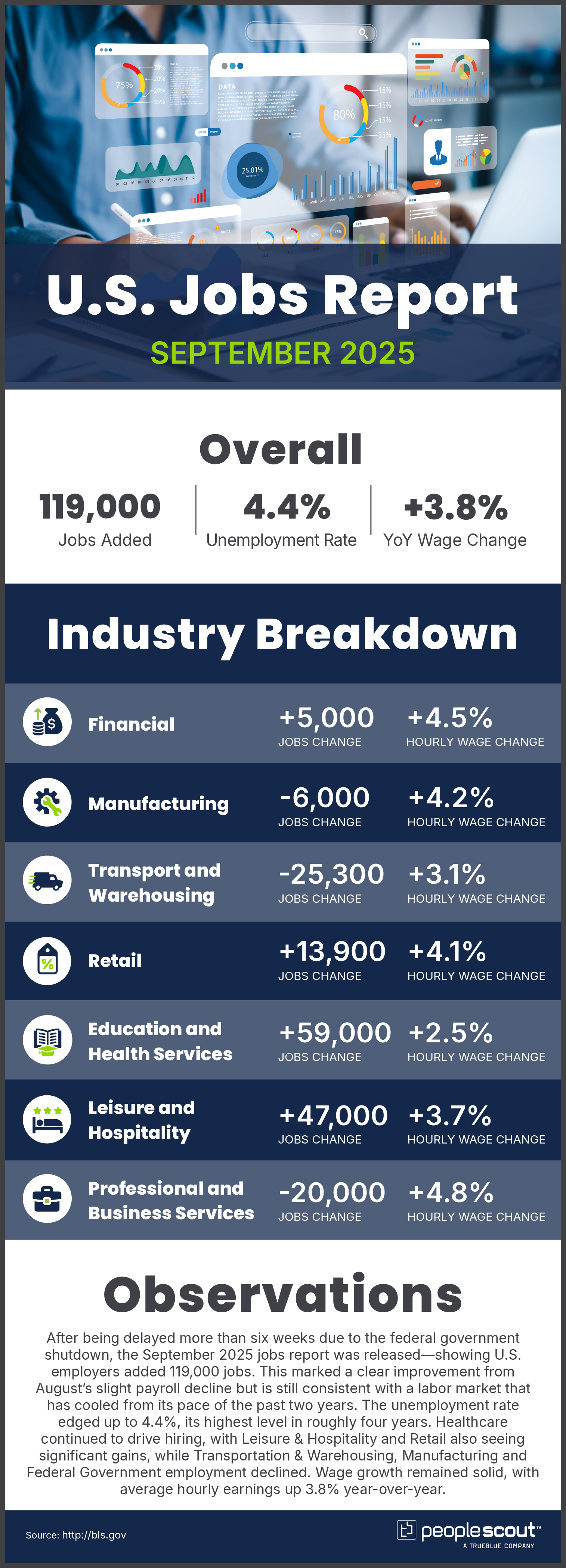

After being delayed more than six weeks due to the federal government shutdown, the September 2025 jobs report was released—showing U.S. employers added 119,000 jobs. This marked a clear improvement from August’s slight payroll decline but is still consistent with a labor market that has cooled from its pace of the past two years. The unemployment rate edged up to 4.4%, its highest level in roughly four years. Healthcare continued to drive hiring, with Leisure & Hospitality and Retail also seeing significant gains, while Transportation & Warehousing, Manufacturing and Federal Government employment declined. Wage growth remained solid, with average hourly earnings up 3.8% year-over-year.

The Numbers

- 119,000: U.S. employers added 119,000 jobs in September.

- 4.4%: The unemployment rose slightly to 4.4%.

- 3.8%: Wages rose 3.8% over the past year.

The Good

September’s stronger-than-expected payroll gain suggests the labor market retained more momentum heading into the shutdown than many had anticipated. Education & Health Services once again led job creation, adding 59,000 positions, while Leisure & Hospitality payrolls rose by 47,000. Retail also contributed modestly, adding nearly 14,000 jobs. Wage growth of 3.8% year-over-year remains comfortably above pre-pandemic norms and continues to outpace inflation. The average workweek edged up, and overall labor force participation rose to 62.4%, with the increase driven entirely by women in their prime working years, who are nearing last year’s record participation levels.

The Bad

Despite the surprise in headline job growth, the broader picture remains one of a sluggish labor market. Total nonfarm payrolls have shown little net change since April, and August was revised to show a loss of 4,000 jobs, marking the second monthly decline this year. The unemployment rate rose to 4.4%, the highest since the later stages of the pandemic recovery, indicating that job creation is not fully keeping pace with labor force growth. Sector weakness was evident across Transportation & Warehousing (-25,000), Manufacturing (-6,000) and Professional & Business Services (-20,000). While initial claims for unemployment benefits remain low, continuing claims have been drifting higher, suggesting that displaced workers may be taking longer to find new roles.

The Unknown

September’s report captures labor market conditions prior to and during a record-long government shutdown that delayed data collection and disrupted normal economic activity. With the October report canceled and October and November payrolls to be combined and released in mid-December, policymakers, employers and investors are operating with an unusually limited and lagged view of labor trends. At the same time, employers continue to face a complex environment including elevated inflation, tighter financial conditions, shifting trade relationships and changes in immigration and industrial policies. The rise in the unemployment rate will be closely watched by the Federal Reserve as it weighs whether to approve a third consecutive interest rate cut at its December meeting, and without another employment report before that decision, interpretations of September’s mixed signals will take on outsized importance.

Conclusion

The September 2025 jobs report portrays a labor market that is steady but subdued. The extended government shutdown has further complicated the picture by delaying data, canceling October’s report and compressing the flow of information policymakers rely on. Against this backdrop, organizations should prioritize workforce planning, scenario modeling and flexible talent strategies—balancing near-term caution with the need to be ready for shifts in demand once the policy outlook and economic data become clearer later in the year.