The Australia Bureau of Statistics released its March Labour Force Key Statistics showing slower job growth compared to the past year.

The Numbers

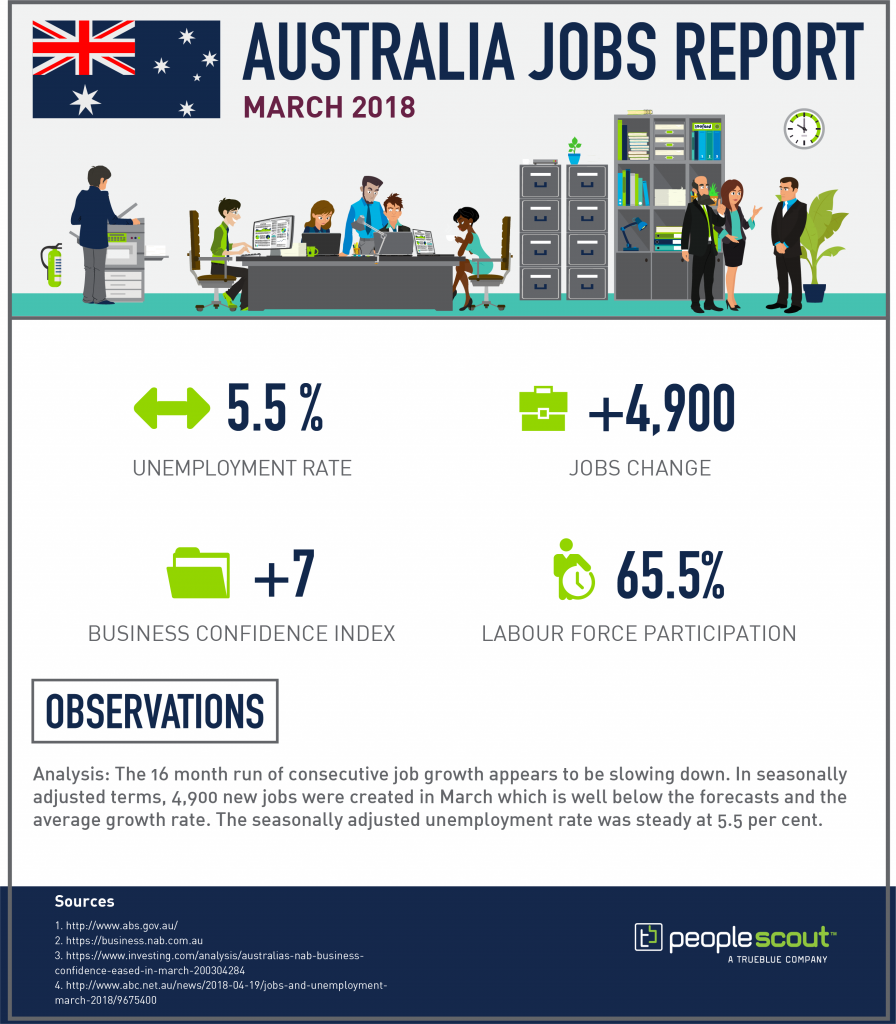

4,900: The Australian economy added 4,900 jobs in March.

5.5%: The Australian unemployment rate remained steady at 5.5 per cent.

65.5%: Labour force participation decreased 0.1 per cent to 65.5 per cent.

+7: According to the NAB, the business confidence index fell two points to +7 index points.

Upside

The 4,900 jobs added to the Australian economy in March brings employment growth over the past year to 367,100, as reported by Business Insider. Employment remains at a record high 12.48 million. The largest increase in employment was in Victoria, followed by Tasmania and Western Australia. Since March 2017, full-time employment has increased by 226,900 persons, and part-time employment has increased by 140,200 persons.

Additionally, the unemployment rate initially reported as 5.6 percent in February was adjusted down to 5.5 per cent. That rate held steady in March. According to Marketwatch, the country is still not yet at full employment.

Downside

The 4,900 jobs created in March fell well below economists’ expectations. This is a sign that the strong run of monthly job increases could be slowing down. Full-time employment actually decreased by nearly 20,000 in March, but an increase of nearly 25,000 jobs created the net increase in employment. There was also a small decrease in the labour participation rate.

The business confidence rate also dropped two points in March to +7. This is still slightly higher than the historical average, but it has fallen four points in just two months.

Unknown

The significant slowing of job creation in March may mark the end of a period of strong sustained job growth. Decelerated job growth has implications for the broader Australian economy, though economists still debate what could happen. While there is still room to grow in Australia’s economy, some economists believe the growth could slow.

Tom Kennedy of JP Morgan notes, “Much of the positivity RBA officials have had on the labour market of late has come from the fact that employment growth boomed last year, with raw job creation making it easy to paper over the various headwinds facing the consumer, such as benign wages growth and high levels of household indebtedness.

However, we had previously flagged the surge in employment growth and participation as being correlated phenomena. While early days it appears this view is broadly tracking, and we retain our forecast for participation to stabilise and employment growth to moderate in 2018.”

![[On-Demand] AI in Recruiting: Hype, Ethics & Best Practices](https://www.peoplescout.com/wp-content/uploads/2024/03/ai-webinar-1-320x320.jpg)