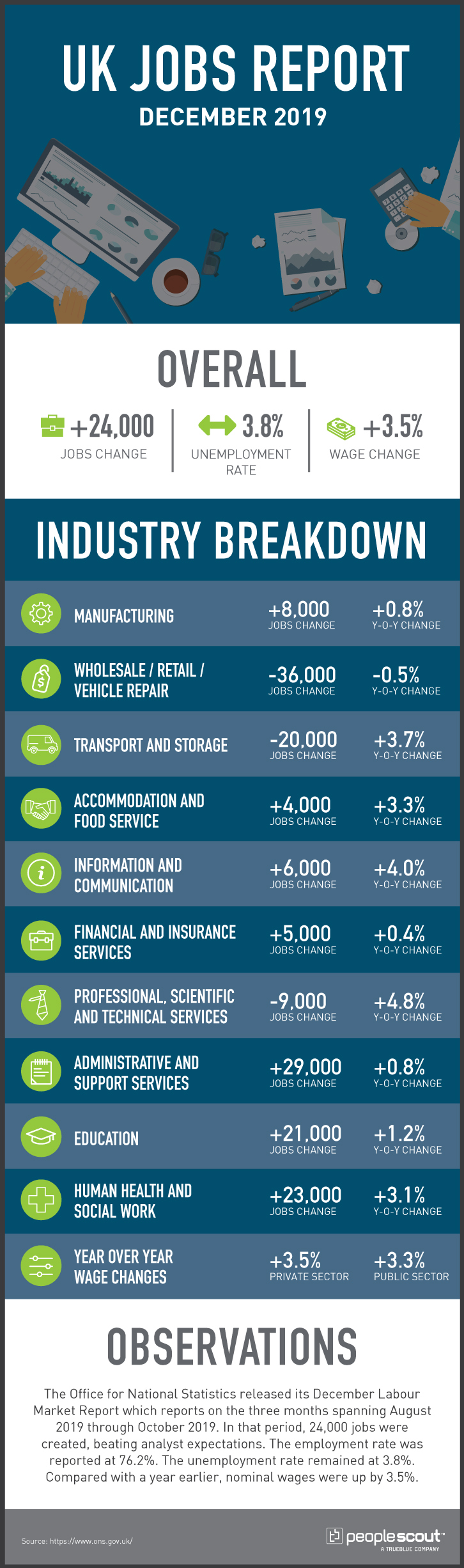

The December Labour Market Report released by the Office for National Statistics, which includes the three month period covering August through October 2019, reported that 24,000 jobs were gained as the unemployment rate held at 3.8%.

Notable figures from the December report include:

- The UK employment rate was estimated at 76.2%, 0.4 percentage points higher than a year earlier but with very little change over the previous quarter. Despite just reaching a new record high, the employment rate has had only small fluctuations over the last few quarters.

- The UK unemployment rate was estimated at 3.8%, 0.3 percentage points lower than a year earlier but largely unchanged over the previous quarter.

- Estimated annual growth in average weekly earnings for employees slowed to 3.2% for total pay (including bonuses) and 3.5% for regular pay.

Slight Job Gains after Consecutive Losses and Continued Low Unemployment

The 24,000 new jobs were welcome news after consecutive reports posting more than 100,000 job losses. The gains, while modest, beat analyst expectations, with one poll of economists predicting a median loss of 10,000 jobs. One particularly encouraging data point was an increase of 8,000 jobs in manufacturing, although a new study showed that a recent downturn in manufacturing output could have serious repercussions for the UK economy overall.

The unemployment rate continues to be very low at 3.8%. It has not been lower since the final quarter of 1974, well before the living memory of much of the nation’s workforce. The UK economic inactivity rate was estimated at 20.8%, 0.2 percentage points lower than a year earlier but mostly unchanged over the previous quarter. The inactivity rate includes those in their prime working years who have not been seeking work within the last four weeks and/or unable to start work in the next two weeks.

The modest job gains and recent losses are viewed by some economists as part of a trend of diminished growth in employment compared to recent years. While uncertainty over Brexit may have played a role, employers have also faced challenges finding talent with the right skills for their open positions. As Tej Parikh, chief economist at the Institute of Directors, noted, “The UK’s jobs boom continues to be a big plus point for the economy, but it is slowly losing momentum. Businesses have shown a strong appetite to take on staff in recent years, and climbing employment levels have boosted household incomes, adding buoyancy to the economy. However, firms are now cutting back on new hires as it becomes harder to find the skills they need.”

Steady Decrease in Job Vacancies and Wage Growth Outpacing Inflation

The number of job vacancies has been dropping since early 2019. For the September to November 2019 period, there were an estimated 794,000 vacancies in the UK—20,000 fewer than for the previous quarter (June to August 2019) and 59,000 fewer than the previous year. (Job vacancies in the UK are reported over a three-month period beginning one month later than the other major labour market estimates.) While the fall in job vacancies has coincided with a drop in the unemployment rate, a continuing downward trend in open positions could have the adverse effect of discouraging additional workers to join the nation’s workforce next year.

The rate of annual pay growth reached 3.9% in the May-July 2019 period and was the highest nominal pay growth rate since 2008. In the August to October period, it dropped to 3.5%. While the annual pay increases are still well above the rate of inflation, there is no evidence future strong rate increases which have emerged in the past during times of very low unemployment.

Shifting Talent Pool

The period of the labour market report released today ended in October, more than a month before the national referendum, the results of which greatly increased the probability of Brexit on January 31, 2020. However, even while there was uncertainty over whether an exit from the European Union would ever come to pass, some striking migration figures began to emerge. The Office for National Statistics reported last month that net migration from the EU to the UK fell to its lowest level since 2003. In November, more than 140,000 EU citizens applied to live and work in the UK after Brexit adding to a backlog of more than 360,000 applications from those who are still waiting for a decision. At the same time, the level of non-EU migrants into the UK is reaching near record highs.

The volatile and fast-changing availability of talent from abroad adds to the already challenging conditions of extremely low unemployment faced by UK employers. Because of uncertain environment, partnering with experts in both the evolving talent market and employee acquisition such as a recruitment process outsourcer in the months to come may never have been more important as a factor to an enterprise’s success than in the year to come.