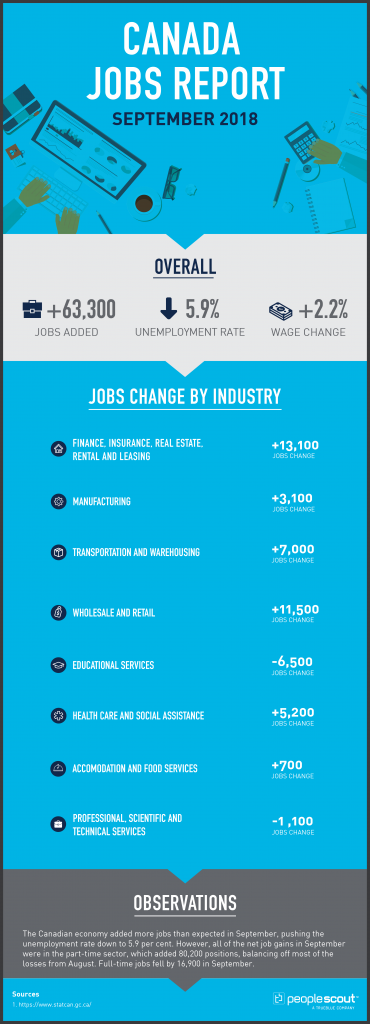

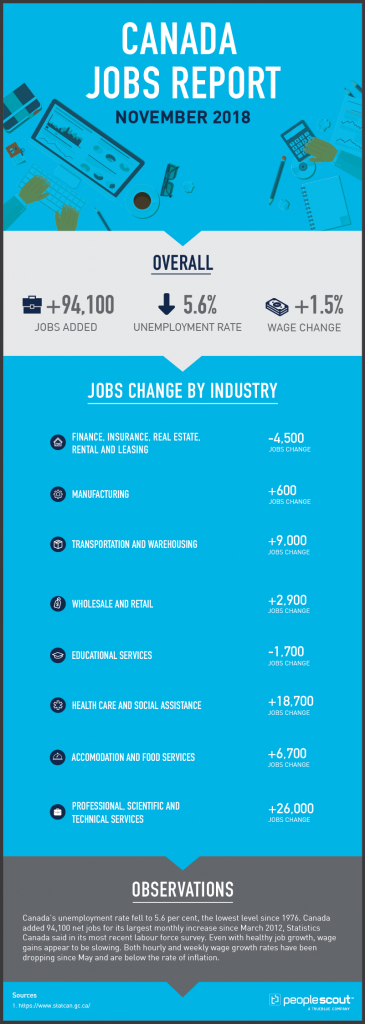

Canada’s unemployment rate fell to 5.6 per cent, the lowest level since 1976. Canada added 94,100 net jobs for its largest monthly increase since March 2012, Statistics Canada said in its most recent labour force survey. But even with healthy job growth, wage gains appear to be slowing. Both hourly and weekly wage growth rates have been dropping since May and are below the rate of inflation.

The Numbers

94,100: The economy gained 94,100 jobs in November.

5.6%: The unemployment rate fell to 5.6 per cent.

1.5%: Weekly wage increases are 1.5 per cent over the last year. This is a 0.3 per cent decrease from October’s wage growth figure.

The Good

The 94,100 jobs gained in November were fueled by 89,900 new full-time positions and 78,600 employee jobs in the private sector. Employment among the core age group (those aged 25 to 54) was up 49,000 in November, the result of increases for both women (+32,000) and men (+17,000). The unemployment rate fell by 0.4 percentage points to 4.6 per cent for core-aged women, and by 0.2 percentage points to 4.7 per cent for core-aged men. In the 12 months to November, employment within this age group rose by 208,000 (+1.7 per cent), largely the result of gains for women (+129,000). In the 12 months leading up to November, employment grew by 219,000 or 1.2 per cent.

Employment was up in six provinces including Quebec with 26,000; Alberta with 24,000; Ontario with 20,000; British Columbia with 16,000; 5,500 in Saskatchewan and 2,600 in Manitoba. On a year-over-year basis, the number of private sector employees rose by 146,000 (+1.2 per cent), while the number of public sector employees grew by 48,000 (+1.3 per cent).

The Bad

Average weekly wage growth fell to just 1.5 per cent and hourly wage growth slowed as well as the CTV reports:

“Year-over-year average hourly wage growth for permanent employees continued its decline in November to 1.46 per cent — its lowest reading since July 2017.

‘There’s no question that the headline job growth is gangbusters strong,’ said Frances Donald, head of macroeconomic strategy at Manulife Asset Management

‘I would caution us against celebrating too quickly, however, because wage growth is decelerating sharply.’”

Experts have been expecting wage growth to pick up its pace, thanks to the tightened labour market. But the opposite has been happening — wage growth has dropped every month since its May peak of 3.9 per cent and now sits well below inflation.

Employment declined in information, culture and recreation (-10,000 or -1.3 per cent), continuing the downward trend that started in August. The decrease was driven by Ontario. Compared with 12 months earlier, employment in this industry was down by 25,000 (-3.2 per cent) at the national level.

The Unknown

The Financial Times reports that the digital economy has created a demand for 216,000 more tech workers, according to a new study. However, it is unclear whether there are enough available workers in Canada to meet this demand:

“Blockchain, artificial intelligence, 5G mobile networks, 3D printing and virtual reality are creating a need for digital skills that will see a demand for an estimated 216,000 additional technology workers by 2021, according to a new report.

A study by the Information and Communications Technology Council (ICTC), found that employment of information and communications technology professionals outpaced the economy last year six-to-one.

‘What’s happening now is we are seeing fast-paced industries go from low growth to high growth,’ said Namir Anani, president and chief executive of ICTC.

‘We have to look at how do we reposition the workforce rapidly through short-duration training to provide pathways and mobility to get into fast-growth sectors of the Canadian economy that are increasingly becoming digital.’

As more industries recognize the importance of a digital strategy, competition for tech workers has increased. ICTC highlighted transportation, retail, healthcare, finance and manufacturing as sectors where demand is ramping up.

‘The environment is changing fast and every sector is seeing its own disruption,’ Anani said.

‘We have to reflect as a country on how do we leverage (disruption) and what are the transitional strategies we have to build to move some of the displaced workers from low-growth to high-growth areas of the economy.’

There was a five per cent increase in employment for digitally skilled workers in 2017, the highest growth in 10 years, according to ICTC’s report. Meanwhile, 60 per cent of Canada’s tech workers were now spread across non-tech sectors.

Not only are Canadian companies struggling to find enough digitally skilled workers to fill positions in the present, but the largest group of tech workers is already approaching retirement, with 13.1 per cent being between the ages of 55 to 64. ICTC’s research was conducted with the support of Microsoft Canada.

‘The issue is really about supply and demand. The demand is increasing as more sectors are adopting digital technologies and the supply of talent and skills is a challenge,’ said Navdeep Bains, the federal Minister of Innovation, Science and Economic Development.

‘When we put forward our Innovation and Skills Plan, by far this was the number one issue — around training and people having the right skills to succeed today and for the job tomorrow.’”