Across the global economy, organizations are making a rational short-term calculation: automate the entry-level, reduce headcount costs and redeploy senior staff—augmented by AI —to cover broader workloads. The efficiency gains are real. The quarterly savings are visible.

But it’s worth pausing to ask what this strategy looks like not now, but in 2033.

The entry-level role has never simply been a unit of labor. It has been the first stage of a decade-long process by which junior professionals become senior ones—accumulating judgment, domain knowledge, institutional memory and leadership capability. When that first stage becomes automated, the impacts extend beyond cost savings for organizations today. They may be quietly reducing the pipeline of experienced talent they’ll need when AI reaches its own ceiling: the domains of complex negotiation, ethical judgment, client relationships and strategic leadership that no current model can replicate.

This article examines the current state of global youth employment, the structural dynamics driving the decline of entry-level hiring and the long-term talent questions that organizations may not yet be considering.

The State of Global Youth Employment

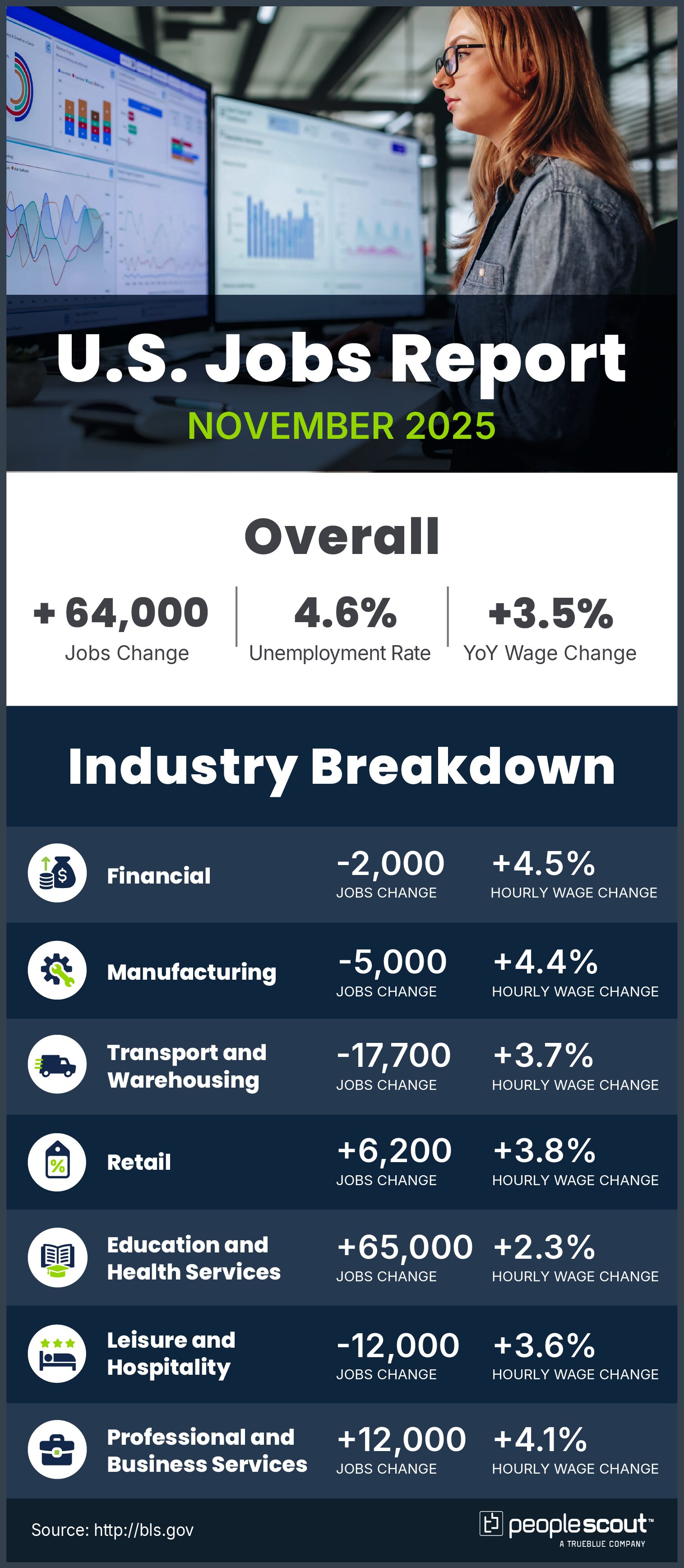

Across advanced economies, the youth unemployment rate sits at approximately 11.2%—nearly twice the adult rate—affecting an estimated 64 million young people aged 15–24.

But unemployment figures alone don’t capture the full picture. More than one in four young people worldwide are not in employment, education or training (NEET). Among an overall hiring slowdown in the United Kingdom, economic inactivity among 16–24-year-olds has risen sharply since 2020, driven by deteriorating mental health, rising living costs and a growing sense among young people that the formal labor market doesn’t offer a credible path to financial stability.

A Snapshot by Country

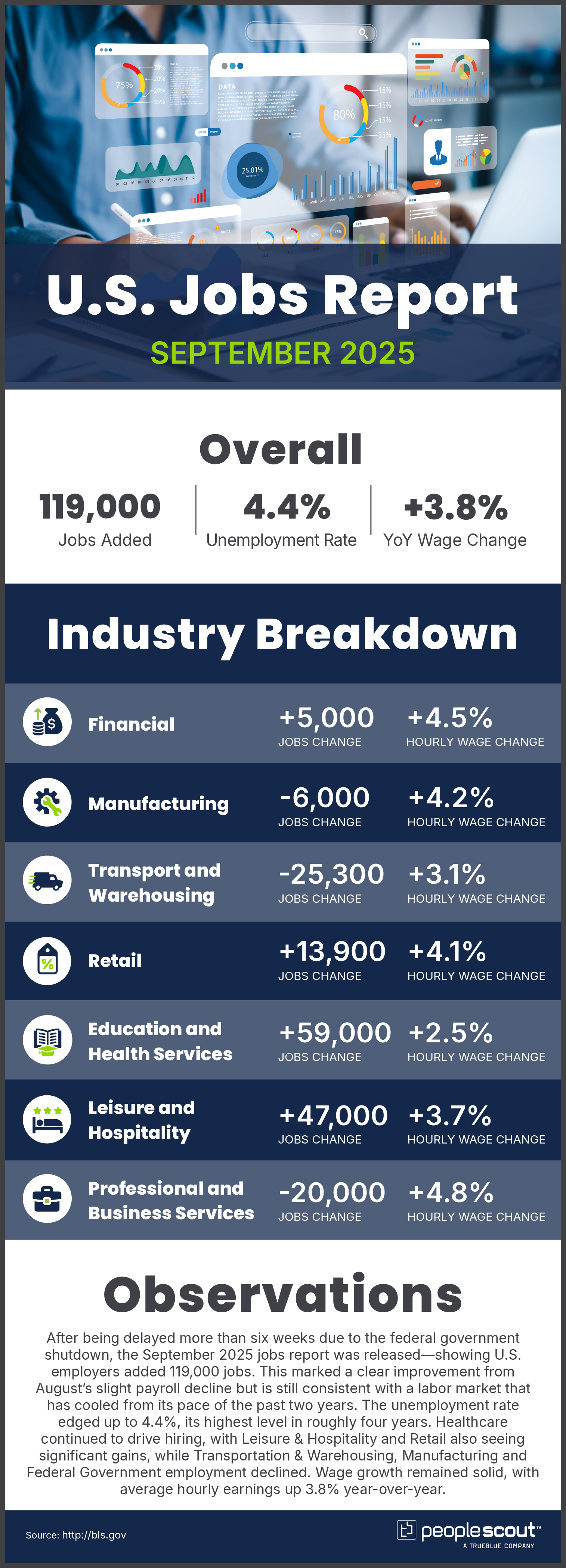

While AI and automation are global forces, their impact on youth employment varies significantly by market—and the variation is largely explained by how employers and governments have prioritized entry-level talent development as a shared investment.

Germany, with a youth unemployment rate of 6.6%, runs a dual education system in which students split their time between classroom instruction and structured workplace practice. By the time they formally qualify, they are already partially integrated into a company’s workflow. Employers participate in curriculum design, ensuring the transition from education to employment is managed and gradual.

Singapore (5.7% for under-30s) takes a similarly deliberate approach through its SkillsFuture initiative. When AI automates a function, the goal is to ensure workers are already trained for the next layer of value-adding activity, rather than left behind by it.

By contrast, Spain (25.3%), France (18.9%), and the UK (16.1%) present a starker picture.

In Spain, where nearly 1 in 4 young people are unemployed, a dual labor market divides older workers with protected contracts from youth cycling through temporary, low-skill roles.

In France, despite heavy government subsidy of apprenticeship programs, multiple assessments highlight persistent skills imbalances, with parts of the education and training system still struggling to adapt to employers’ needs.

The U.S. (9.0%) and Australia (9.5%) sit in the middle. Headline numbers look functional but mask a quieter hollowing-out of entry-level opportunities. Many graduates are entering the workforce through the gig economy or into service roles that don’t leverage their post-secondary education. They’re formally employed—but may not be engaged in professional development while on the job.

How AI is Reshaping the Job Market

AI is the most significant and rapidly evolving factor impacting the youth employment picture today. Since 2022, Gen AI has moved from a niche technology to a standard workplace tool. But its impact is more about redistribution than replacement.

Historically, junior positions have served as vital training grounds, allowing young professionals to learn foundational skills, understand workplace dynamics and build networks. The roles most affected by AI automation are those that have traditionally been junior positions, like data analysis and reporting, content production, basic legal research, administrative coordination, junior software development and customer-facing support. They’re task-oriented and repeatable, which makes them a natural fit for automation.

As AI absorbs those repeatable tasks, senior employees can manage broader scopes of work without junior support. The result isn’t mass layoffs of existing young workers — it’s a sustained reduction in the creation of new entry-level positions. A recent study from the Stanford Digital Economy Lab, shows that employment for U.S. workers aged 22-25 in “AI-exposed” roles fell by 13% between 2022 and 2026, driven largely by a decline in new hiring rather than existing job losses.in new hiring rather than existing job losses.

These are not peripheral roles. They are the apprenticeship layer of the knowledge economy—and when they disappear, so does much of the on-ramp to professional development and career growth.

The Retirement Gap: A Question Worth Asking

We know that the Baby Boomer and Generation X cohorts currently occupying senior leadership positions are already exiting the workforce and will continue to do so over the next decade. What’s less well understood is how that shift interacts with suppressed entry-level hiring.

The journey from junior professional to senior leader isn’t a short one. In most knowledge industries, getting from first job to senior director takes ten to fifteen years. Which means the professional who doesn’t get hired in 2026—because the entry-level role they would have filled has been automated—isn’t in the running for senior leadership in 2038. They simply aren’t in the pipeline.

The risk, if this trend continues at scale, is a gap in the organizational hierarchy in the mid-2030s where mid-level managers and experienced specialists would ordinarily sit. This gap would be most acute in AI-exposed professional domains—precisely where automation is currently most prevalent.

When senior leaders retire, organizations will face a choice: hire experienced professionals externally or promote from within. For organizations that have built healthy pipelines, internal promotion is viable. For those that have largely automated, and therefore eliminated entry-level roles, it may not be. And if many organizations in an industry make the same decisions, the external market won’t have the talent pipeline to compensate either.

The cost of acquiring senior talent is already rising, and it may eventually exceed the cumulative cost of the entry-level investment that organizations sought to avoid through AI and automation in the first place.

The AI Ceiling and the Human Premium

There’s also a shift worth noting in what employers say they’re looking for at the junior level. The traditional value proposition of the junior hire was potential: raw capability that could be shaped through on-the-job training, mentorship and progressively more complex work. The employer was making an investment.

Increasingly, that investment seems to be narrowing. Recent employer surveys suggest that AI capabilities have become a non‑negotiable part of the junior hiring profile: roughly two‑thirds of executives say they would not hire candidates without AI skills. The expectation of a learning curve has been compressed: more than three‑quarters of business leaders say that entry‑level employees who already have AI skills will be given greater responsibilities, reinforcing an expectation of immediate AI‑enabled productivity rather than slower on‑the‑job upskilling.

The tension here is that the AI-adjacent technical skills most in demand at the entry level today are also the skills most likely to be obsolete within three to five years as AI capabilities continue to advance. Meanwhile, demand for deeper human competencies—critical thinking, ethical judgment, complex negotiation and emotional intelligence—that are developed by working alongside experienced practitioners, has increased over time.

As AI manages more of the technical execution, the value of these human-centric skills appears to be rising. But those skills can’t be developed if the junior hire never happens.

What This Means for Talent Acquisition and HR Leaders

These dynamics warrant deliberate consideration. Organizations that recognize the long-term implications of today’s efficiency decisions will be better positioned than those that don’t.

Key considerations for protecting your long-term talent pipeline:

Reframe the Entry-Level as a Future Talent Investment, Not Headcount Cost

Today’s junior hire is tomorrow’s senior leader—one with institutional knowledge, organizational loyalty and capabilities that can only be developed through sustained, progressive experience. The ROI is long term, but it’s real. Organizations that factor in the future cost of external executive search, sign-on packages and productivity loss from outside appointments may find that internal pipeline development looks considerably more favorable than standard headcount analysis suggests.

Audit the Developmental Quality of Existing Junior Roles

Organizations that have retained some entry-level hiring should consider whether those roles are genuinely developmental in practice. The risk is that junior roles are retained in title but hollowed out in substance—reduced to AI oversight functions that don’t build the analytical, relational or strategic depth that matters at the senior level. If, after two years, an employee in a junior role demonstrates little growth beyond managing AI tools, the role may not be serving its pipeline function.

Engage with Systemic Solutions

The country-level evidence shared above makes it clear: organizations in markets with structural educational and vocational frameworks (Germany, Singapore) have better access to work-ready, developmentally prepared young talent. In markets where those frameworks are weaker, HR leaders have both an incentive and an opportunity to help build them—through apprenticeship design, university curriculum partnerships and engagement with government-led workforce initiatives.

Assess for Future Value, Not Just Immediate Fit

Often, candidate screening and assessment—especially when AI-driven recruitment tools are involved—are calibrated to match current role requirements. This can deprioritize candidates with high potential but limited formal experience, which describes most entry-level candidates. It’s worth reviewing whether your screening criteria adequately weigh indicators of potential: learning velocity, cognitive flexibility and evidence of initiative, alongside experience proxies.

Conclusion: Rebuilding the Ladder

The current global youth employment picture isn’t just a social policy concern. It raises a genuine strategic question for employers: what are the long-term workforce consequences of automating entry-level tasks?

The entry-level role serves two purposes: producing value in the short term and developing experienced professionals in the long term. While AI is increasingly capable of delivering the first in many domains, it’s much less capable of substituting for the second. Organizations that optimize entirely for cost savings may find, in time, that they’ve traded away something even more valuable—experienced human judgment.

Though the career development ladder hasn’t been destroyed by AI, its bottom rungs are being quietly removed. It’s worth asking, now, whether the organizations playing the efficiency game today will regret it when the time comes to climb.